International trade in the world market is conducted around the world using the U.S. dollar as the reserve currency. Trade is critical to nearly all countries the world over. Here in the U.S. there are some products that we produce far more than we can consume and we have to sell our goods overseas. It is the same for other countries; China as a manufacturing center, produces anything they want to in any amount. The main ingredient in manufacturing is labor and they have a lot of very cheap labor; therefore, they need to export their goods and U.S. is their biggest customer.

As countries produce and market their goods, the natural tendency is for their currency to appreciate, making the products they produce more expensive for other countries to buy. Small increases can produce stable growth, large increases can setup a financial bubble.

Since the financial crash in 2007 the yuan appreciated, in real trade-weighted terms a whopping 40% through May 2015. This partly reflected nominal appreciation against the U.S. dollar, with effective appreciation against the euro, yen, Korean won, and other currencies.[i] During this time period the U.S. dollar gained strength mostly because we were the best option compared to the other world currencies.

China’s biggest drop in its currency valuation in over 20 years occurred last month due to export concerns and China’s economic growth. The decline of foreign reserves illustrates the cost to China as it tries to prop its economy and alleviate the outflow of capital from the country, which has now threatened the nation’s economic position. The shrinkage in foreign reserves means less money flowing into China’s financial system. Many economists believe that it is inevitable China will see continuous capital outflows and continued depreciation of its currency in the ensuing months.

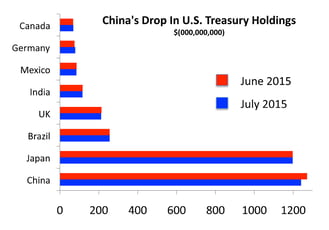

Federal Reserve data released in September showed that China started to liquidate U.S. government Treasuries as early as July. During the same period, several nations maintained their holdings in U.S. Treasuries. China actively reduced its position in Treasuries by over 2.5 percent in less than one month, amounting to a $30 billion reduction. China has been and continues to be the single largest foreign holder of U.S. government Treasuries worldwide, amounting to nearly $1.25 trillion in value. U.S. Treasuries are the single most liquid securities held by foreign entities worldwide.

One cause of volatility in our markets in part due to the actions of governments. Allowing their currency to rise and then suddenly devaluing it that can cause such volatility in our markets. Changes in currency valuation cause uncertainty in the markets and investors react by converting their investments to cash. In time, investors regain the previous confidence and put their money back in the market. Bidding it back up. China’s devaluation of their currency caused our markets to head south. This reflects two questions: 1. With China now as an economic powerhouse, how does the U.S. make room for two at the top? and 2. Think of what the rest of the world goes through when the U.S. market has a cold or our government does something unpredictable; how do we, as the U.S. population, now cope with a more unstable government? Our government stability is so very important in the world. Perhaps you may have other questions to ask? please ask in the comments below.

Economic growth is important to all countries, it is their life blood. Trading with other countries is a critical part of that growth. China is certainly a market to be watched closely, considering their size, the amount of U.S. Treasuries they own, and the products they produce. There economy now is almost the size of the United States – any day now, they will be the largest economy in the world.[i] Is China in danger of falling into the trap that killed Japan? 10/16/2015 By Jeffrey D. Sachs

Source: Federal Reserve

To Remember:

"Bull markets are born in pessimism, grow in skkepticism, mature in optimism and die in euphoria, I don't see any signs of euphoria." Sir John Templeton