With this being memorial day weekend perhaps it is appropriate to address the idea of mourning or grieving with those who have lost loved ones. So, what can you do when you or someone you know loses a family member or a close friend is a topic that I think everyone needs to pay attention to. Grief is real. It is intensely personal and can only be moved forward by the person feeling the loss. Helping someone through the grieving process is not instinctive and can be very hard - learn what you can so you can be of more assistance.

Within a span of 22 months I lost four people I was very close with, my close friend and business partner, my brother-in-law, who was my best friend and help keep me on the right path as a teenager, we backpacked the John Muir Trail together; my oldest brother, who was my first business partner; and my angel mother, who continues to bless my life by her example of faith and strength.

Considering my business of financial planning at times I have had to deal with the passing of a client or a family member and help people through the financial stresses of settling an estate (not probate). All the life insurance claims, filed changing accounts to the beneficiary, etc. The over-riding element others should express to those who are grieving is kindness.

Karen de la Cruz, Professor of Nursing says, “Researchers have suggested many grief models over the years, such as Elizabeth Kubler-Ross’s five stages of grief (denial, anger, bargaining, depression, acceptance), but these are just constructs for trying to make sense of an experience that usually doesn’t make much sense. And they can do harm when used to dictate how a person “ought” to grieve.”

de la Cruz continues, “The five stages are rough guidelines. They don't happen in order and they’re much more fluid than was originally thought. You can go back and forth between them, you can be in more than one stage at once, and not everyone goes through every stage.”

“People grieve according to their own temperament, coping style, age or stage of life, relationship with the deceased, and previous experiences with death,” says de la Cruz.

While there is no right way to grieve, there are wrong ways to treat those who are grieving. A friend who lost her father a week ago, commented that Monday night she was out with some friends and her boy friend, when someone happened to play a song that was played at her father’s funeral. She got a little teary eyed about and one of the fellows in the group said, “@#*^ life happens, get the @#*^ over it!” Clearly a horribly wrong thing to say. (Not to mention the fact that using foul language is inappropriate.)

Sue Bergin’s, a hospice chaplain and bereavement counselor, for 10 years, shares a list of what to do and what not to do - to support grieving friends or family.

- Don’t assume you have to talk. A hug or a squeeze of the hand can be more comforting than words.

- Don’t tell your own grief story unless asked.

- Don’t offer advice - of any kind.

- Don’t assume that if someone has faith in the next life, they will have less need to grieve.

- Don’t say things like “He’s in a better place” or “At least her suffering is over”. Any sentence that begins with the phrase “at least” is received as minimizing and isn’t comforting.

- Don’t impose your personal beliefs about death and the afterlife on the griever.

- Do give grievers your full, focused attention.

- Do share your memories of the loved one and encourage grievers to share theirs.

- Do invite grievers to short, low-intensity activities, such as a lunch, family home evening, or a walk or bike ride.

- Do allow a griever to express his or her honest feelings, including anger at God and anger at the deceased.

- Do share a book or other resource that has helped you with grief.”

I like this list, it provides some great counsel and clear thinking about what to do and what not to do. It reminds me of a talk I heard years ago by Sally Karioth, Ph.D., she said something to the effect, don’t say to the person “if there is anything I can do please just let me know?” The griever will never call and impose, after all often they don’t know what they need. She said the best thing is to “jump in and do something”… go mow their lawn if it needs it, bring them a bottle of soda pop, or a meal, clean their house, just don’t get in the way, try to do things that do not impose on the person too much as they need their space too.

My favorite is to take or send a big bag of Peanut M&M’s with a note that says, “here is something to share when people come calling.” However you can show kindness and give a listening ear is best. I hope that we will all be a little more sensitive to those who have lost someone dear in this life. While this topic does not have much to do with economics, it does matter deeply to the people affected by a loss.

Source BYU Magazine

REMEMBER:

"Empty pockets never held anyone back. Only empty heads and empty hearts can do that." - Norman Vincent Peale

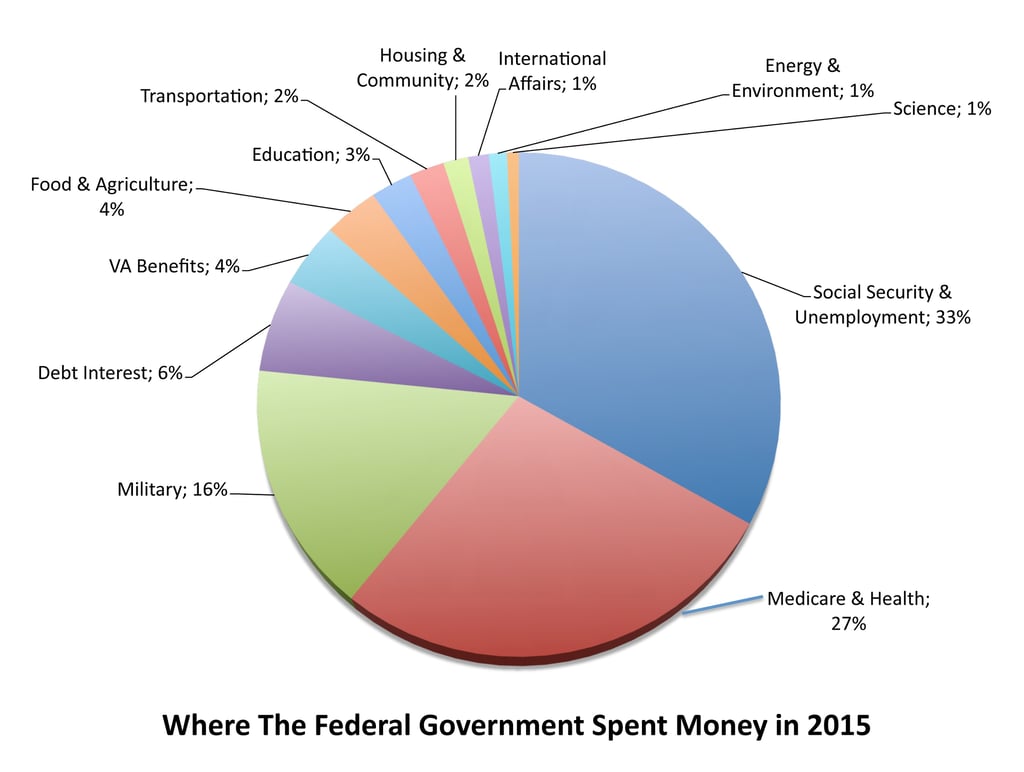

Its important to note that the what is paid in taxes and what the federal government budgets are two different numbers - the difference is the deficit and is borrowed from the federal reserve bank and other countries around the world. The 2015 deficit was $439 billion. While the 2015 deficit has come down from previous years, the total public debt continues to rise. The debt continues to rise because every year we add the current year’s debt to the pile already on the books. Bringing our total debt to over $14 trillion dollars today, which is clearly unsustainable. Our nation’s debt is at the level of our GDP - meaning that if we the public spent an entire year working and producing everything this country produces and paid 100% it on the debt we might pay it off, depending on interest rates.

Its important to note that the what is paid in taxes and what the federal government budgets are two different numbers - the difference is the deficit and is borrowed from the federal reserve bank and other countries around the world. The 2015 deficit was $439 billion. While the 2015 deficit has come down from previous years, the total public debt continues to rise. The debt continues to rise because every year we add the current year’s debt to the pile already on the books. Bringing our total debt to over $14 trillion dollars today, which is clearly unsustainable. Our nation’s debt is at the level of our GDP - meaning that if we the public spent an entire year working and producing everything this country produces and paid 100% it on the debt we might pay it off, depending on interest rates. Becoming debt free should be a goal of each person. I have seen young college graduates who have finished school with well over $200,000 in student loans. As one client was telling me it is “discouraging”. The bondage of debt is discouraging! And what do many young graduates do - load up more debt and buy a new automobile! This debt can be extremely onerous! Read more about auto

Becoming debt free should be a goal of each person. I have seen young college graduates who have finished school with well over $200,000 in student loans. As one client was telling me it is “discouraging”. The bondage of debt is discouraging! And what do many young graduates do - load up more debt and buy a new automobile! This debt can be extremely onerous! Read more about auto

Now it is estimated that approximately 55% (40% federal and 15% state) of his estate will go off in estate taxes. Think about this, he worked from a young age (teenager) practicing the guitar to become a world famous musician, amass a large estate because of his successful use of his talent, only to pay huge income taxes all his life and then the final rub to pay another 55% when he passes away. That works out to be $165,000,000 to $275,000,000 paid to the government (state and federal)!

Now it is estimated that approximately 55% (40% federal and 15% state) of his estate will go off in estate taxes. Think about this, he worked from a young age (teenager) practicing the guitar to become a world famous musician, amass a large estate because of his successful use of his talent, only to pay huge income taxes all his life and then the final rub to pay another 55% when he passes away. That works out to be $165,000,000 to $275,000,000 paid to the government (state and federal)!