Here we are at the start of the New Year when folks get to review their contribution limits to their retirement plans. Below are the limits, however depending on the type of plans available and whether or not you are using a qualified or non-qualified plan determines your limits (certain non-qualified plans have no limits).

Often times non-qualified plans may yield more after tax income during retirement than qualified plans will, so it depends on if you want to pay taxes now or in the future. Perhaps, there is a balance between the two? That analysis should be performed.

If you think taxes are going to go up in the future, consider using more non-qualified plans now. You can think about it this way: would you prefer pay taxes on the seeds you plant or all the vegetables you harvest? Both plans take time for money to grow!

For 2016, the elective contribution limit for employees who participate in 401(k)s will remain the same at $18,000 for the year. That is the amount that a saver can contribute annually on a tax-deferred basis, and it also applies to many plans offered by nonprofit and government employers. The catch-up contribution for employees age 50 and over will remain the same at $6,000, so someone in that age group could contribute a total of $24,000. (Matching contributions from employers do not count against this figure.)

IRA annual limits remain unchanged at $5,500, with the catch-up contribution for those 50 and over also flat at $1,000. Of IRA holders who contributed to their plan, 53.5% contributed the maximum annual amount, according to data from the Employee Benefit Research Institute (EBRI).

A change to Roth IRAs is the ability for workers to earn more and still be able to contribute to a Roth. Individuals making contributions to Roth IRAs have a new AGI phase out range, which is $184,000 to $194,000 for married couples filing jointly, up from $183,000 to $193,000 in 2015.

For small business owners (and their employees) you may consider a SEP. Contribution limits for 2016 is $53,000 or 25% of total compensation, whichever is less. Employers must contribute the same percentage for all employees; often in a one person business the maximum is contributed.

If you are changing jobs, rolling over a 401(k) into a self-directed IRA is most often the best choice. The typical 401(k) plan may have anywhere from 12 to 25 investment options and often many over-lap in asset classes. For example: a large cap growth fund, an S&P 500 index fund and a large cap value fund.

There can be enough of an overlap in those three funds that there is little distinction between them. So really, you do not have three choices you have one, when trying to diversify based on asset class. Achieving a well balanced portfolio in a 401 (k) plan can be tricky as the fund offerings are not always clear. As a suggestion you may want to look at this article for a basic format on how you might rebalance your 401(k) plan.

A self-directed IRA can allow you to invest, quite literally, A-Z type of investments. From precious metals, rental real estate, stocks, bonds, mutual funds, ETF’s, Annuities, commodities, alternative investments, REITS, and the list goes on. Many of these options have additional risks associated with the investments, but often time’s practical knowledge can help minimize those risks.

Work with your investment advisor to help make the right decisions for you and your current situation, doing the best you can to plan for your future. Examine the use of both qualified and non-qualified retirement plans and their complete income tax effects on income as well as your Social Security Benefits. Additionally, you should be familiar with the three legs of retirement planning: investments, estate planning, and long-term care. If you do not have an investment advisor I would be happy to answer your questions and help you understand which strategy is best for you, your business, and family – give me a call or click on the link below. In everything you do, I wish you the best of success.

Sources: IRS, Employee Benefit Research Institute

Remember:

"When you cannot do what you do what you have always done, then you only do what maters most" Robert D. Hales

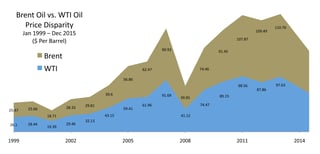

Realization of an oversupply issue put pressure on oil prices throughout 2014 & 2015. Crude oil production in the U.S. has surged because of the technology behind horizontal drilling and hydraulic fracturing, primarily in the states of North Dakota and Texas. Fracking makes it possible to extract oil and natural gas in places where conventional technologies are not effective. Fracking involves the use of high water pressure combined with sand and chemicals to create cracks in rock that allow the oil and natural gas it contains to escape and flow out of a well.

Realization of an oversupply issue put pressure on oil prices throughout 2014 & 2015. Crude oil production in the U.S. has surged because of the technology behind horizontal drilling and hydraulic fracturing, primarily in the states of North Dakota and Texas. Fracking makes it possible to extract oil and natural gas in places where conventional technologies are not effective. Fracking involves the use of high water pressure combined with sand and chemicals to create cracks in rock that allow the oil and natural gas it contains to escape and flow out of a well.