Hardly anyone likes taxes, but some are more offensive than others. Here are three that are pretty big offenders. I don’t think folks mind paying some taxes, but it’s when it takes nearly five months of work to hit tax freedom day that it becomes a greater burden. Not to mention the waste that is found in government, so these three taxes can and ought to be fixed.

Alternative Minimum Tax - AMT

Once upon a time, Congress dreamed up the alternative minimum tax (AMT), which is an add-on to the “regular” federal income tax. The stated reason for the AMT was essentially to make sure that the rich who benefit from multiple federal income-tax breaks still have to pay at least something to the Treasury. Oddly enough, the rules for this tax were poorly crafted, thereby allowing for creative math to come into play, of course, erring on the side of the IRS.

One can consider the AMT as a separate tax system. The AMT will affect certain types of income that are tax-free under the regular tax system, while not allowing some regular tax deductions. Also, the maximum AMT rate is “only” 28%, versus 39.6% under the regular tax system.

The most likely AMT victims are upper-middle-income individuals who pay relatively high state and local income and property taxes and have spouses and kids. The truly rich ($750,000+) are rarely affected, and this is for two reasons.

First: Their marginal regular federal income rate is 39.6%, while the maximum AMT rate is 28%. So the regular tax bill for a person with really high income will usually exceed the AMT bill. On the other hand, folks in the upper-middle-income zone may have enough regular tax deductions that they pay an average regular tax rate lower than the AMT rate. If so, they will get hit with the AMT.

Second: Many tax breaks for really high-income folks are already cut back under regular tax rules before they even get to the AMT calculation. For instance, the passive activity loss rules restrict tax benefits from traditional tax-shelter investments like rental real estate and limited partnerships. And if your income exceeds certain limits, you’ll run into phase-out rules that chip away or eliminate your personal and dependent exemption deductions, your biggest itemized deductions, and your tax credits. So you may have little or nothing left to lose under the AMT rules. In contrast, folks in the upper-middle-income zone often have lots to lose, such as significant deductions that are allowed for regular tax but disallowed under the AMT rules. As a result, they wind up owing the AMT.

You are allowed a relatively generous AMT exemption, which would be the equivalent to a deduction when calculating your AMT bill. But unfortunately, the exemption is phased out at higher income levels. If your AMT bill exceeds your regular tax bill, then of course you will owe the higher AMT amount.

Varying factors make it difficult to figure out who will be affected by the AMT and who won’t. But here are some general guidelines:

- Your income is high enough ($250,000 or more) that a good part or all of your AMT exemption is phased out.

- You have relatively hefty deductions for state and local income and property taxes under the regular tax rules (say, $20,000 or more). These deductions are not allowed under the AMT rules.

- You have a spouse and several kids, which translates into four or more personal and dependent exemption deductions under regular tax rules. These deductions are not allowed under the AMT rules.

- You exercised an in-the-money incentive stock option (ISO). The so-called bargain element (the difference between the market value of the shares on the exercise date and the ISO exercise price) does not count as income under the regular tax rules, but it counts as income under the AMT rules.

- You have a significant deduction for home equity mortgage interest. Under the regular tax rules, you can deduct interest on up to $100,000 of home-equity loans. But under the AMT rules you can only deduct interest on loan balances of up to $100,000 that are used to acquire or improve a first or second residence.

- You have write-offs for miscellaneous itemized deduction items (such as investment expenses and fees for tax advice and preparation) under regular tax rules. These deductions are disallowed under the AMT rules.

Social Security or FICA Tax

The second tax that has some serious flaws is the Social Security tax. It can be just as expensive as the federal income tax for many folks, especially self-employed individuals.

If you are an employee, your wages will be reduced by the 12.4% Social Security tax up to the annual wage ceiling. Half the Social Security tax bill (6.2%) is withheld from your paychecks. The other half (also 6.2%) is paid by your employer.

Unless you closely examine your pay stubs, you may be completely unaware of how much the Social Security tax is actually costing you. Potentially, a lot! The Social Security tax wage ceiling for 2014 is $117,000, and it will be even higher next year. If your wages meet or exceed the $117,000 ceiling for this year, the 2014 Social Security tax hit will be a whopping $14,508 (12.4% x $117,000).

If you are self-employed as a sole proprietor, partner, or limited liability corporation (LLC) member, you know the full cost of the Social Security tax all too well. That’s because you must pay the entire 12.4% rate out of your own pocket, via the self-employment tax.

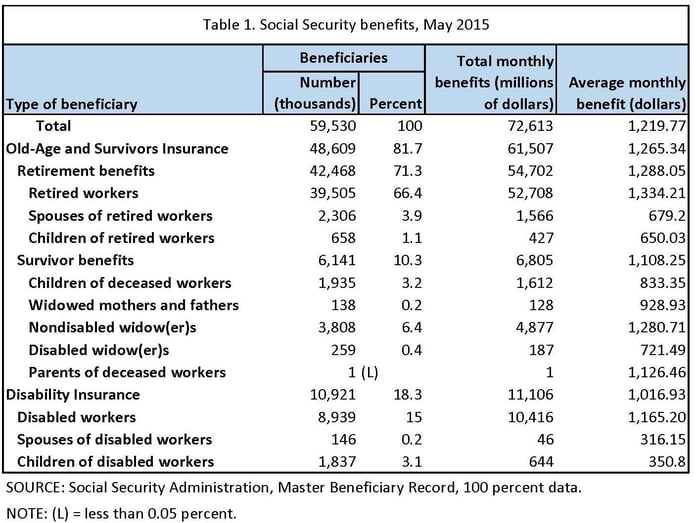

But there is a disconnect between the Social Security tax and the benefits. While the Social Security tax ceiling increased by 2.9% from 2013 to 2014 (from $113,700 to $117,000), Social Security benefits only increased by 1.5%. This scenario has occurred routinely in the past few years, and they aren't stopping now! According to Social Security Administration projections, the Social Security tax ceiling in 2022 will be $165,600, which equates to a $20,534 Social Security tax bill (12.4% x $165,600). That is a hefty tax, especially considering it is in addition to regular income tax as well as all the other taxes!

Social Security Benefits Tax

And this leads us to the third unfair tax. When you start receiving Social Security benefits, you may be surprised to discover that between 50% and 85% of your payments get hit with federal income tax (the taxable percentage goes up with your income). Incredible, right?

As I just explained, you already paid Social Security tax years ago in the form of withholding from your wages or the self-employment tax. Plus, you already paid federal income tax on those Social Security taxes years ago, because they were included as part of your taxable salary or self-employment income. Now you are paying tax on the benefits too. That amounts to double taxation, or maybe even triple taxation depending on how you look at it. While retirees with very low income, less than $32,000 per year, won’t get taxed on their Social Security benefits, everybody else will take a hit.

Tell us what you think about these taxes are they a burden on your family? How would you solve the problem of these taxes?

.

.