Recently I was in a meeting and the thought occurred to me; why do people even attempt to have a financial plan? What is the purpose of having a financial plan? Why take the time to create a financial plan and put forth the effort to implement it and follow through with it? The answer to these questions may sound obvious, but as I have studied financial planning and worked in the financial industry for the past 30 years, I have concluded that people have an innate desire to be self-reliant. However being self-reliant is a learned trait while we may have the innate desire, we have to act on it, and learn self-reliance.

What does it mean to be self-reliant? According to Dictionary.com, the adjective originated around 1826 and means, “relying on oneself or on one’s own powers, resources, etc.” Another definition, one that is a little broader is this: The ability, commitment, and effort to provide for the spiritual and temporal necessities of life for self and family. Both definitions explain the necessity to provide for one’s self.

The second definition is more comprehensive. My thinking is; how can you be self-reliant if you are not mentally or spiritually in the game? Can someone provide for self and others without that inner strength that comes from being mentally or spiritually prepared? I believe that self-reliance is more than just a good job and a fat bank/retirement account(s).

Self-reliant people not only have a good source of income, they have money in the bank, investments, as a friend of mine would add some food storage, debt free, and they are spiritually and mentally able to care for their own. This is a challenge in todays world where people are pulled in every direction, often wasting time and money. In some cases, children don’t have a complete understanding of what it took to earn the money they are now spending.

With the challenges of providing for one’s self and family, may I submit that it would also include the necessity to continue to learn and improve one’s self. Consistently learning and integrating new concepts of truth, would help a person accomplish a goal of self-reliance. For example read good books, work with a mentor, be a mentor, help someone else reach their goals.

How does someone become self-reliant? Here are six ideas that will help you become more self-reliant:

- Pay yourself first: Take some money out of each pay check and send it to savings (savings accounts, retirement accounts, investment accounts). The discipline of saving money and living on less than one’s income is a critical part of self-reliance.

- Using a family budget: Using a budget is one of the basic principles of good money management. See more here

- Risk management: Risk management is taking care of the risks we are exposed to on a daily basis. There are four things that can be done with the risks:

- Keep the risk yourself and personally pay for the things that may happen

- Control the risk through behavior

- Prevention - don’t engage in behavior/activity that would enhance the risk

- Transfer the risk through some means of insurance.

- Be prepared: Things happen in life that cause great pain or financial difficulty (loss of a job, divorce, death of a loved one, business reversal, etc.) These trials may cause us to stretch and grow in ways we never knew we could, so finding, and developing coping skills is critical (developing the mental/spiritual side of self-reliance).

- Daily improvement: Find something to do on a daily basis that will help you improve various aspects of your life. For example each morning, I spend time, praying, reading, writing in a journal, exercising, and meditating.

- Become debt free: Debt is truly a bondage that never sleeps, never eats, is always your companion where ever you go; becoming debt free is a blessing of self-reliance. Get out of debt!

These steps towards complete self-reliance take time and work. Don’t be too hard on yourself if you are not self-reliant in the next year - keep working towards it. “Claim progress”, as my wife would say. Map these things out how you personally might implement them in your own families’ and measure your progress. And then realize that life happens and each of us can experience a reversal.

Reversals that can cause a person to be completely wiped out and they have to start over, some people go through life with no issues at all (at least not that we see), so be patient with people around you as we are all be on the road to self-reliance, we aren’t at the same level, or we may have just suffered a reversal.

Finally, remember that there is always hope; keep the embers of hope alive by working on the above six items in some manner, as part of your financial plan regularly measure and keep track of your efforts, and you will become self-reliant.

REMEMBER:

"Strive not to be a success, but to be of value." ~ Albert Einstein

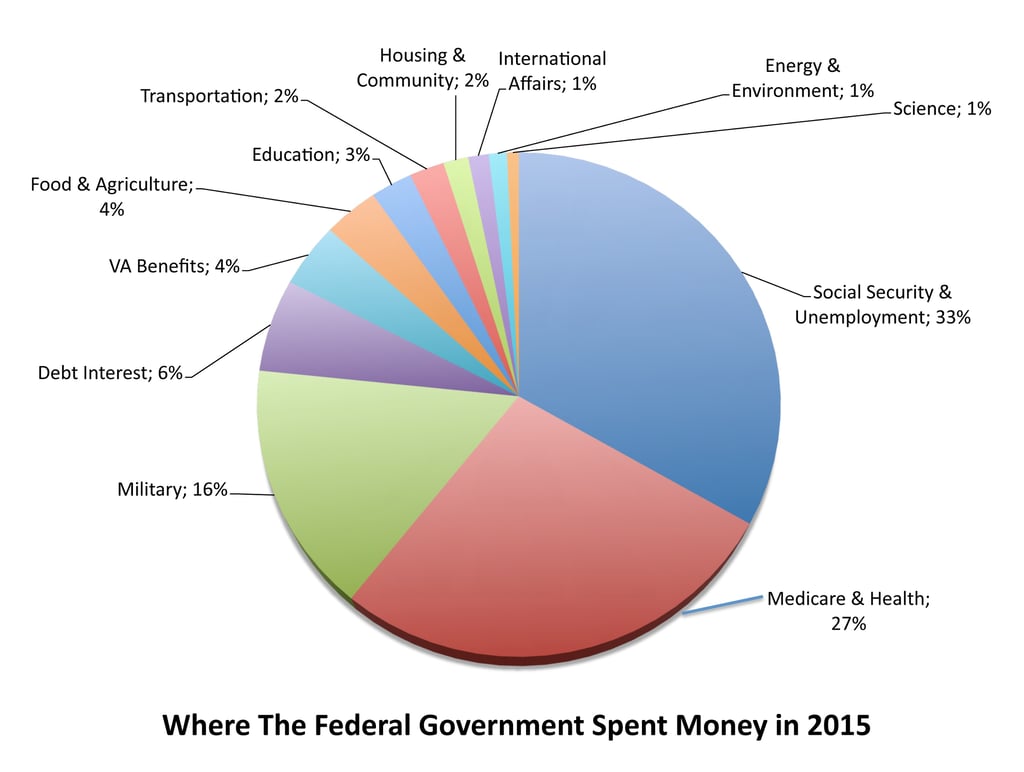

Its important to note that the what is paid in taxes and what the federal government budgets are two different numbers - the difference is the deficit and is borrowed from the federal reserve bank and other countries around the world. The 2015 deficit was $439 billion. While the 2015 deficit has come down from previous years, the total public debt continues to rise. The debt continues to rise because every year we add the current year’s debt to the pile already on the books. Bringing our total debt to over $14 trillion dollars today, which is clearly unsustainable. Our nation’s debt is at the level of our GDP - meaning that if we the public spent an entire year working and producing everything this country produces and paid 100% it on the debt we might pay it off, depending on interest rates.

Its important to note that the what is paid in taxes and what the federal government budgets are two different numbers - the difference is the deficit and is borrowed from the federal reserve bank and other countries around the world. The 2015 deficit was $439 billion. While the 2015 deficit has come down from previous years, the total public debt continues to rise. The debt continues to rise because every year we add the current year’s debt to the pile already on the books. Bringing our total debt to over $14 trillion dollars today, which is clearly unsustainable. Our nation’s debt is at the level of our GDP - meaning that if we the public spent an entire year working and producing everything this country produces and paid 100% it on the debt we might pay it off, depending on interest rates.