Interest rates are the economic rain to the world economy. Like rain, when there is too much, it causes flooding and will swamp growth; not enough and a drought ensues then economies don’t thrive. The Fed controls the spicket. Current rates are hurting savers and the retired. While at the same time allowing the government to borrow trillions to grow at dirt cheap rates.

This causes a dilemma: the government needs the cheap interest rates; the retires and savers need higher rates to maintain a shrinking standard of living. This conflict is a problem the world over: what to do about low stagnant interest rates?

The events in Europe along with the International Monetary Fund (IMF) report released in June indicating that U.S. economic growth would fall short of expectations. This is one reason that prompted the Federal Reserve to subdue its pursuit of any additional rate increases this summer.

Britain’s vote on the EU exit sent U.S. government bond yields to new multi-year lows as well as dimmed trade growth prospects between Europe and the U.S. The dollar’s recent rise is also a headwind for the U.S. since a rise in the dollar’s value drags on U.S. exports; putting downward pressure on U.S. inflation, which is well below the Fed’s 2% target for inflation.

The problem here is, as other countries have economic “occurrences” they send money to the U.S. to buy our treasuries, which are perceived to be a safe haven for storing cash. When a flood of money comes in, it lowers the interest rates people are willing to take just to park money. After all, getting something is far better than getting nothing or losing money all together.

As more flows in - it strengthens the dollar, which also makes it harder for us to export our goods and services to other countries. It does make it cheaper for us to buy stuff from other countries and to travel, but that may not be the current objective.

Concurrently, the IMF report released in June suggested that the U.S. faces economic “headwinds” and “pernicious” trends including a shrinking middle class that could slow growth in the long term.

Labor’s share of U.S. income is about 5% lower today than it was 15 years ago, while the middle class has shrunk to its smallest size in the past 30 years. Demographic changes are slowing potential growth and that in turn, is affecting business investment and leading to a less dynamic labor force. The IMF is estimating that U.S. GDP will grow 2.2% this year, which is down from 2.4% in 2015. This may seem like a small percent, but it works out to be $36.0 billion out of an $18 trillion economy. This much money could employ 720,000 people at $50,000 per year. That is a lot of money and a lot of middle class jobs!

Economists believe that both of these occurrences will foster an elongated low interest rate environment throughout the domestic and international fixed income markets. When factoring in the need for the federal government to keep borrowing such large amounts of money for both the annual deficit, and the rolling over of previous year’s debt obligations low interest rates help “feed the pig” so to say, causing income pain to the retirees and savers!

So how does this affect you and your investment or retirement portfolio? Low rates are generally good for the stock market, companies are able to borrow more to expand and grow. Now would be a good time to refinance any debt that may have higher rates or better yet, get it paid off. When debt is paid off early it is like earning that same interest rate. So for example you pay off a credit card that charges 18 percent then you have just earned that 18 percent on the balance by removing that future interest payment obligation. This is not to say go borrow a bunch of money at a high rate and then work to pay it off.

Rearranging your portfolio to a more balanced strategy may help with market upsets and continued low rates. Participating in several asset classes will properly diversify your portfolio. For more information  .

.

Tot the extent you can get your own house in order you will be greatly strengthened when the headwinds really hit hard. As the old saying goes, it is nice to “sleep when the wind blows”.

Sources: IMF, Bloomberg, Federal Reserve

Remember:

Those who don't understand interest, pay it; those who do, earn it. - Anonymous

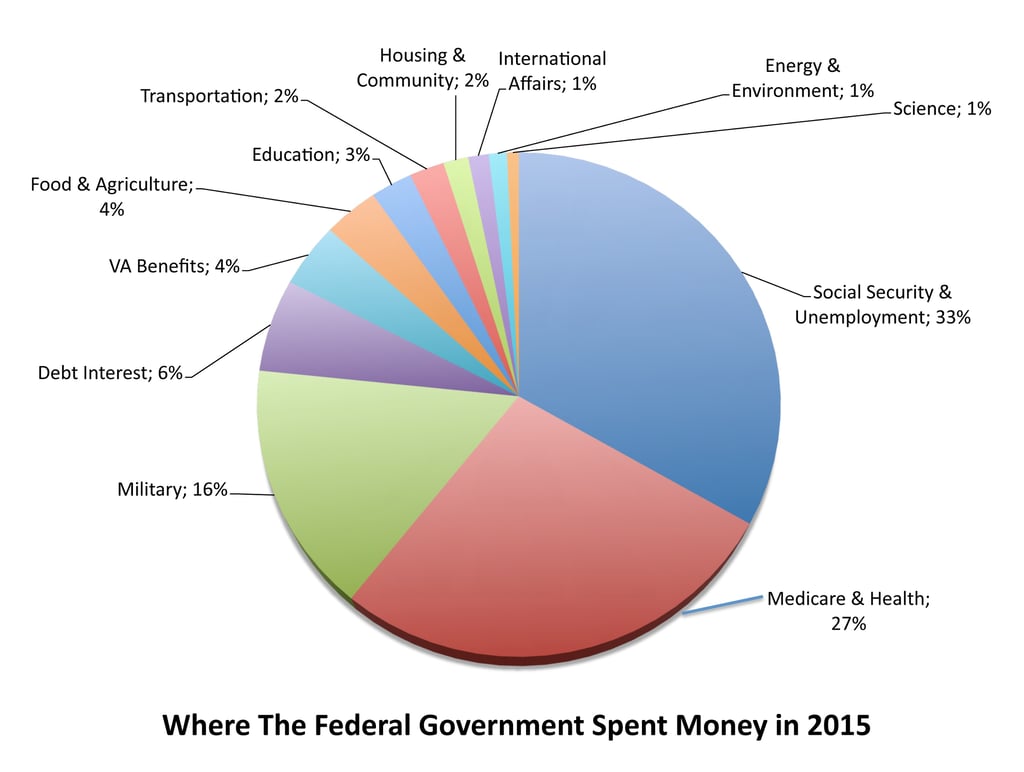

Its important to note that the what is paid in taxes and what the federal government budgets are two different numbers - the difference is the deficit and is borrowed from the federal reserve bank and other countries around the world. The 2015 deficit was $439 billion. While the 2015 deficit has come down from previous years, the total public debt continues to rise. The debt continues to rise because every year we add the current year’s debt to the pile already on the books. Bringing our total debt to over $14 trillion dollars today, which is clearly unsustainable. Our nation’s debt is at the level of our GDP - meaning that if we the public spent an entire year working and producing everything this country produces and paid 100% it on the debt we might pay it off, depending on interest rates.

Its important to note that the what is paid in taxes and what the federal government budgets are two different numbers - the difference is the deficit and is borrowed from the federal reserve bank and other countries around the world. The 2015 deficit was $439 billion. While the 2015 deficit has come down from previous years, the total public debt continues to rise. The debt continues to rise because every year we add the current year’s debt to the pile already on the books. Bringing our total debt to over $14 trillion dollars today, which is clearly unsustainable. Our nation’s debt is at the level of our GDP - meaning that if we the public spent an entire year working and producing everything this country produces and paid 100% it on the debt we might pay it off, depending on interest rates.