Each month, the Energy Information Agency (EIA) tracks the price of gasoline nationwide as well as how much households (consumers) are buying overall.

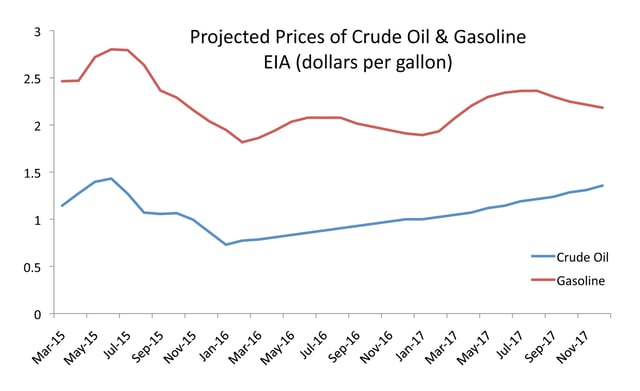

The EIA expects gasoline prices to start rising this year, while continuing to head higher into 2017 as demand picks up and supply levels drop. Gasoline prices had been falling because of lower crude oil prices, which account for about two-thirds of the price U.S. drivers pay for a gallon of gasoline.

Increases in fuel economy are also contributing to lower fuel expenditures, as cars and trucks are more efficient and travel farther on a gallon of gasoline. According to the Environmental Protection Agency, the production-weighted fuel economy of cars has increased from 23.1 miles per gallon for 2005 cars to almost 28 mpg for 2014 cars, an increase of over 20%. Similarly, the fuel economy for trucks has increased 19%, from 16.9 mpg to 20.1 mpg in the same timeframe.

The Consumer Price Index (CPI), a statistical measure of inflation, has gasoline accounting for 5.1% of consumer spending as of October 2014. Reductions in gasoline prices ultimately impact the relative weight of gasoline compared to other expenditures such as shelter, clothing, food, and entertainment in price indices compiled by the Bureau of Labor Statistics (BLS) and the Bureau of Economic Analysis.

The demand for gasoline is very price inelastic over short time periods, meaning changes in price have little impact on the number of gallons used. Falling gasoline prices allow households to spend their income on other goods and services, pay down debt, and/or increase savings. However, the longer prices remain low, the more time households have to plan for driving vacations and decide on where to spend their excess money.

Sources: EIA, Commerce Dept., BLS, EPA

Remember:

"If you can't make them see the light, make them feel the heat." - Ronald Reagan