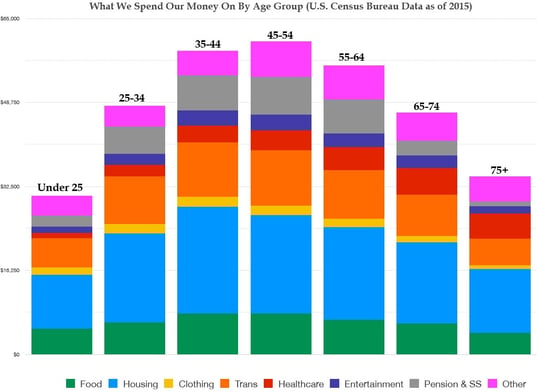

Demographics play a significant role in how much we spend and how we spend it. Spending is primarily dictated by age where different needs and life essentials change and evolve as consumers grow older. For many families some financial obligations never go away.

Housing, transportation and food are the three largest expenses incurred by all age groups. These basic expenses often fit into the typical needs that many families have for life insurance. When looking at how much insurance to get people should consider an amount that will cover these expenses long into their future. People, even after retirement will still have these expenses.

retirement will still have these expenses.

These long lasting expenses should be covered with a permanent insurance policy, like whole life. Where the premium will remain level for your entire life. For example a base policy might be something in the area of $250,000 to $500,000 in coverage. Such a policy is much less expensive in a person’s younger years, making them very cost effective over the long term.

As consumers move from their late 20s into their 30s, we earn more money and families start to grow. Expenditures on transportation, health care and entertainment become prevalent as households grow with children. These more temporary expenses would typically be covered by term insurance. When the financial need or obligation is completed the insurance can be dropped. This allows a family to be covered for the extra needs for vary little money, while at the same time maintaining their base whole life policy, which will provide the needed protection long after retirement.

As we earn more, we also tend to save more in our 30s, 40s, and 50s by contributing to 401k plans and retirement savings. At 75 years of age and older, our retirement savings start to reduce as withdrawals increase to replace lost earned income. Retirement savings is critical to your financial success. The life insurance is what secures the retirement savings. However, even with a large retirement account or pension, the basic need for insurance may not ever go away. How have you determined your needs for life insurance? With September being National Life Insurance Month - now is a great time to review your coverage.

There is the simple acronym: DIME with the meaning: D: Debts; How much do you have in outstanding debt obligations (excluding your mortgage)? I: Income; What amount of your income do you want to replace and for how long? Mortgage: How much would it take to pay off your mortgage? E: Education; What do you want to leave for your children and/or grandchildren for education expenses?

Now add these DIME numbers up and get the total. Subtract from the total how much life insurance you currently have in place and that is your current need. Typically, your current needs may range from 10-20 times your annual income, with up to about three to seven times your annual income as a base amount. Review the second paragraph up top to determine your very long term needs and see how this matches up.

Sources: Social Security Administration, U.S. Census Bureau

Whatever excuses you may have for not buying life insurance now will only sound ridiculous to your widow!

- Unknown Author