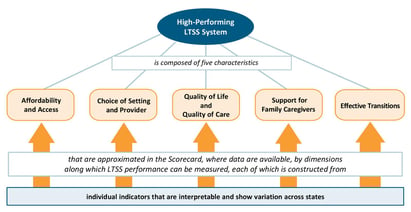

This week an article I saw caught my eye…every three years AARP conducts and publishes a scorecard on how each state performs with regard to caring for our elderly, primarily centered around long-term services and support, basically long-term care. There were five main areas of focus for the study, Affordability and Access, Choice of Setting and Provider, Quality of Life and Quality of Care, Support for Family Caregivers, and Effective Transitions. Now people may say what does this have to do with me? I am working, I have a family, and saving for retirement, I am not interested in long-term services for the elderly.

That may be the case, but if you are on the earth and living, then you have parents who may still be living, and at some point you will have to assist them. Or you are older and you can see the top of the mountain you have been climbing for the past 30 plus years and retirement is getting closer; perhaps you need to stop for a moment on the journey and rearrange the gear in your pack, pickup a few tools to make the decent down the mountain much easier and more secure. Either way this is for you.

Here are some highlights on this interesting article that are important for us to learn.

Most states saw some improvement in fact more improved than declined. Few had meaningful improvement over 10 percent in any one category. The study reported: "Most notably, the majority of the states had no meaningful change in each of the five measures in the Affordability and Access dimension. The cost of Long-term Services and Support (LTSS) over time remains much higher than what middle-income families can afford, and most adults do not have private long-term care insurance." Source: State Long-Term Services and Supports Scorecard, 2017.

It was interesting to see that there was no improvement in the vast population of this country in regards to people becoming more prepared for their future by purchasing Long-term Care Insurance.

One area where there was significant improvement was in the area of Family-Centered Care. Family caregivers provide the majority of care for the elderly and recognizing their needs is a positive signal. The article discussed the success measured across the following three main areas:

- Family caregivers are assessed for their own needs;

- States have adopted spousal impoverishment provisions in Medicaid home and community-based services; and

- States have enacted the Caregiver Advise, Record, and Enable (CARE) Act to notify the family caregiver before the person is discharged from the hospital and to instruct the caregiver on how to perform follow-up medical/nursing tasks."

Families that care for their parents are true angels and it can be so difficult for them, many work and have children at home complicating matters more. Receiving some support in the form of education and understanding of what needs to be done to take care of your partents is huge.

One area where improvement was not so dramatic was in Effective Transitions. Effective Transitions is the process of moving a person from a hospital to a nursing care facility to recuperate and then back into their community. The aim is to help people who have been in nursing homes 90 or more days to transition back into the community. Only a few states saw improvement in this area.

The benefit of this is that people are really more comfortable in their own surroundings, in their own home, which is where they should be. The challenge is that only about 5 percent of people on average who have been in a nursing home greater than 90 days transition back home. Receiving care at home is less expensive as well - saving retirees thousands of dollars.

The bottom line is that state law, best practices and the way people are cared for are changing. If people want to be cared for in their advanced age, it is best to make a plans now, if your parents are retired or over age 50, talk to them about their plans. The government has a plan for you - you will be cared for in one way or another, it may not be a the way you would like, but you will get care! Let your family members know what your plans are and make your wishes known (in writing). Helping those closest to you understand what to do to help is one of the kindest things you can do. Nobody wants to improperly care for a parent or other family member.

Educate yourself on the ins and outs of Long-term Care, learn the differences between assisted living, home health care, and nursing home care. What are the long-term care triggers, and how do they work? Review your budget and look at how you would pay for the different levels of care. Part of your plan may include obtaining some long-term care insurance, make sure the premiums are guaranteed for life. It can be difficult to pay into a policy for several years only to get an unaffordable premium increase.

For more information on other long term articles you can look hereor here. To see how your state did in the AARP study you can look here. The report was well done and offered some real insights into the overall needs of one of our nation's most valuable resources, our seniors.

REMEMBER:

I wish my wallet came with FREE refills! ~ Anonymous