Commodities, such as oil or gold, typically follow an inverse, or negative relationship with the value of the dollar. A stronger dollar makes oil a less attractive commodity on dollar-denominated exchanges, especially in the eyes of investors holding other currencies. When the value of the dollar weakens against other major currencies, the prices of commodities generally move higher.

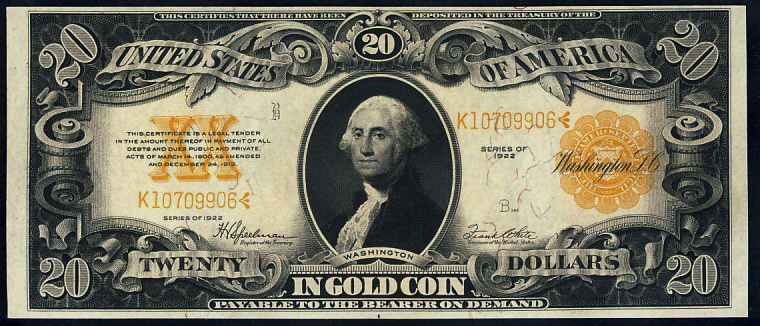

This inverse relationship also happens when countries devalue their currencies through inflation. This is one argument for the gold standard, it is said to keep monitary policies honest.

There are many reasons why the value of the dollar has an impact on commodity prices worldwide, namely commodities are typically priced in dollars. When the value of the dollar drops, it will take more dollars to buy the same amount of commodities. Commodities are traded in dollars because currently the dollar serves as the world’s reserve currency. Some countries, like the BRIC’s (Brazil, Russia, India and China are trying to change that and use the Chinese Yuan as a reserve currency or a basket of currencies from other countries rather than simply the US dollar.

Another reason is that commodities are traded around the world; foreign buyers purchase our commodities: corn, soybeans, rice, wheat, oil, etc., with dollars they have received in trade as we have purchased products they have manufactured. When the value of the dollar drops, they have more buying power and simple economics tells us that demand typically increases as prices drop.

Commodity traders often keep a close eye on the value of the dollar. An easy way to monitor the dollar is to watch the price quotes on the Dollar Index on the ICE Futures Exchange. It is an index of how the dollar is valued against a group of other major currencies around the world. The price of the index is traded like any other futures contract and you can get quotes throughout the day.

Commodity prices don’t necessarily tick higher for every tick lower in the Dollar Index, but there is a strong inverse relationship over time. Individual commodities can also buck the trend if other over whelming forces are causing the price to move along with the dollar.

Lately the dollar has gained strength against a backdrop of many countries whose currencies are weakening. This has been a factor in the lower prices we have seen at the pump. This strengthening has also had an impact on other commodities, precious metals, gold, silver, platinum, etc.

Typically, gold is seen by investors as a backup for the dollar. As the dollar weakens, the price of gold increases. As the dollar gains strength, gold prices drop. It is similar to the relationship between the dollar and oil. Which begs the question, is there a correlation between oil and gold?

There are a couple ideas that try to explain the correlation between gold and oil. One is that prices of crude oil partly account for inflation. Increases in the price of oil result in increased prices of gasoline at the pump. If fuels (gasoline, diesel oil, and aviation fuel) are more expensive, then it’s more costly to transport goods and those prices go up. The final result is increased prices – in other words, inflation.

The second thought on the oil-gold link is the fact that precious metals tend to appreciate when inflation is rising (especially in the current fiat monetary environment). So, an increase in the price of crude oil can, eventually, translate into higher precious metals prices resulting in oil becoming a new economic bench mark similar to gold.

While it usually takes some time for higher commodity prices to materialize as higher prices in goods and services, however for precious metals they trade daily in your portfolio and may trade in line with oil immediately. One explanation can be that, once oil appreciates, precious metals investors correlate the expected future higher prices of goods in the price of gold and it generally goes up.

However, even though the general price level of gold moves in a similar direction to oil, the relationship may not be trade-able based on data for the long term. While the correlation is positive, over longer periods of time and on average, this relationship does not always translate the same for gold and oil returns.

In 2000 oil was trading around $32 per barrel and gold was around $292. Currently oil is trading around $75 and gold at $1,183. Which translates for oil a 134 percent gain over the past 14 years and 305 percent gain for gold. (Obviously, these are low compared to recent highs in the past few years when oil hit around $140 per barrel and Gold was up around $1,800 per ounce.) By comparison, in January 2000 the CPI was at 168.800 and January 2014 the CPI was 233.916 or an increase of 38.6 percent. The low inflation rate compared to the increase cost of oil and gold can partially be explained by the number of times the Government has revised the method of calculating the CPI.

Having said that, it’s still possible for short-term patterns to emerge occasionally. So, even though there seems to be no relationship between gold and oil returns over the long term, it may happen that a relationship unveils itself in a short period of time offering trading opportunities.

In summary, while oil prices do not drive gold prices and gold does not drive oil prices, the main reason the two markets have similar long-term trends, as well as other commodities, is that they have one important long-term driver in common: monetary inflation.

Housing prices are still 13 percent below 2007 levels. Fewer Americans own houses - sending rents up 16 percent, to an average of $1,100 per apartment in metro areas.

Housing prices are still 13 percent below 2007 levels. Fewer Americans own houses - sending rents up 16 percent, to an average of $1,100 per apartment in metro areas.

The Economic Cold War or Financial Cold War has begun slowly over the past several years and the current administration has added fuel to the fire. China and Russia both know it would be extremely difficult to win a ground war against the United States, but a financial war? Maybe not so hard, with our excessive national debt and endless printing of money by the Federal Reserve, they have a real shot at giving the US a serious black eye and maybe even a few broken bones.

The Economic Cold War or Financial Cold War has begun slowly over the past several years and the current administration has added fuel to the fire. China and Russia both know it would be extremely difficult to win a ground war against the United States, but a financial war? Maybe not so hard, with our excessive national debt and endless printing of money by the Federal Reserve, they have a real shot at giving the US a serious black eye and maybe even a few broken bones.