Market forces in the economy help determine the rental rates in every community. Each landlord worries whether the ad they ran to attract a renter, will actually bring one in who will not only pay the rent on time, but take care of the property. And hopefully not burn the place down as one of my tenants did 20 years ago! In any event, I certainly understand the other side too - people want to live the American Dream and own their own property/house/castle! It is hard to make the leap and buy a home, when we are surrounded with economic turbulence and uncertainty. Home ownership requires a higher level of economic stability.

As banks and financial institutions have been mandated to increase their loan qualifications for home mortgages due to government regulations, more and more families are being forced to rent rather than own. As the demand for rentals has been increasing, the level of home ownership has been falling. Some attribute this dynamic to a low inventory of homes on the market, while others blame excessive government requirements imposed on mortgage lenders.

A lack of available rentals along with the increased demand for rentals has propelled rental costs upward. The number of individuals dedicating at least half of their income towards rent hit a record high of 11 million people in 2014, according to the annual State of the Nation’s Housing Report from the Joint Center for Housing Studies.

As rental prices have been rising faster than wages, losing such a large portion of a paycheck to cover housing, means cutting back on essentials such as food, clothing, and health care. This can be draining on young families trying to save for a down payment on a home and then not knowing if they would be able to get approved or not.

Last year saw the biggest surge in new renters in history, according to the report on Housing Studies, bringing the number of people living in rental units to around 110 million people, accounting for about 36% of households. Middle-aged renters made up a substantial portion of the new demand with 40% of renters aged 30-49.

More affluent renters are staying in the rental market longer and driving up the demand for housing. Traditionally, the wealthy move on to become homeowners, but tight inventory in the housing market is keeping them in rentals longer.

The median rent on a new apartment was $1,381 in 2015, according to the report, which means that a renter would have to make at least $55,000 a year before taxes in order to be able to afford the rent.

It is important to remember also that many people rent for various reasons, they are in work transition, divorce, personal choice, students, newly immigrated. The fact that so many poeple rent is not such an issue as the percent of their income going to pay for rent - that is where the government gets all bent out of shape. According to their model, housing should not cost more than 30% of household income.

When 11 million people pay upwards of 50% of their income for rent, this is going to add fuel to the fire for raising the minimum wage or some sort of rent controls. Either way there will be those in government that think they need to "solve this problem". Landlords: Watch Out!

Owning a home or renting requires effort to budget your income properly. Any time housing costs reaches close to 50% of income things get really tight. As one of my old financial planning professors use to say, “There are only two things you can do, help people cut expenses or help increase cash flow.” In life there are only so many expenses you can cut, and for many people you can only pound so many nails in a day. But generally increasing income provides the greatest opportunity. It is wonderful to see people transition from barely making ends meet to an abundance!

Sources: Joint Center For Housing Studies

Remember:

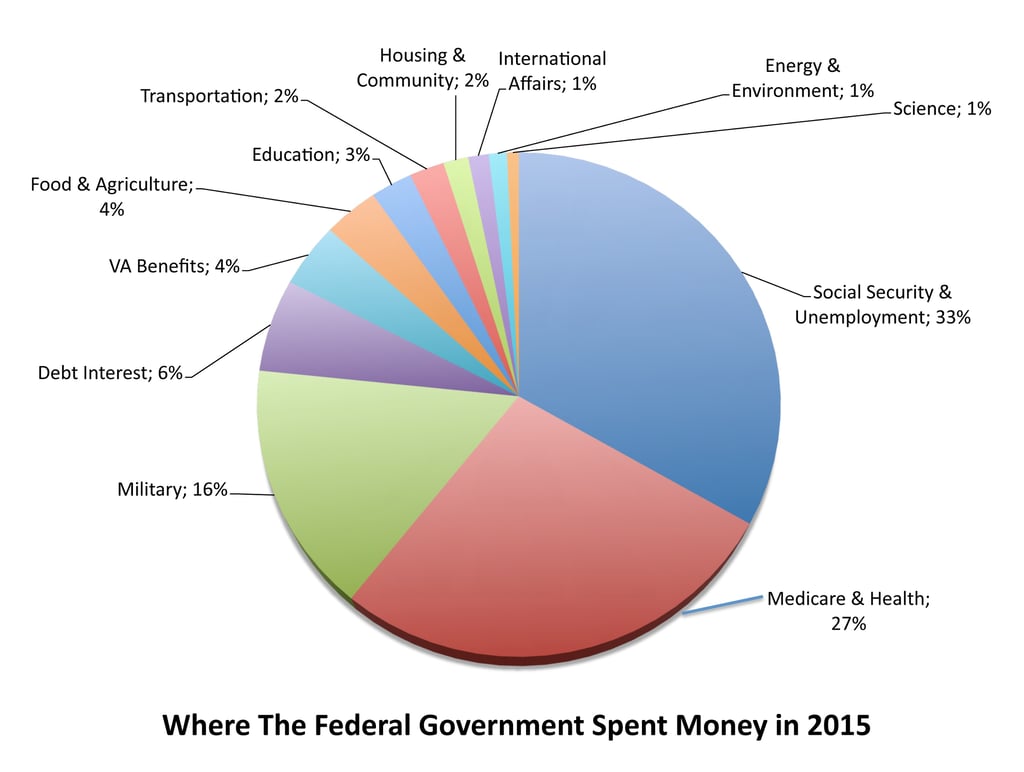

Its important to note that the what is paid in taxes and what the federal government budgets are two different numbers - the difference is the deficit and is borrowed from the federal reserve bank and other countries around the world. The 2015 deficit was $439 billion. While the 2015 deficit has come down from previous years, the total public debt continues to rise. The debt continues to rise because every year we add the current year’s debt to the pile already on the books. Bringing our total debt to over $14 trillion dollars today, which is clearly unsustainable. Our nation’s debt is at the level of our GDP - meaning that if we the public spent an entire year working and producing everything this country produces and paid 100% it on the debt we might pay it off, depending on interest rates.

Its important to note that the what is paid in taxes and what the federal government budgets are two different numbers - the difference is the deficit and is borrowed from the federal reserve bank and other countries around the world. The 2015 deficit was $439 billion. While the 2015 deficit has come down from previous years, the total public debt continues to rise. The debt continues to rise because every year we add the current year’s debt to the pile already on the books. Bringing our total debt to over $14 trillion dollars today, which is clearly unsustainable. Our nation’s debt is at the level of our GDP - meaning that if we the public spent an entire year working and producing everything this country produces and paid 100% it on the debt we might pay it off, depending on interest rates. Becoming debt free should be a goal of each person. I have seen young college graduates who have finished school with well over $200,000 in student loans. As one client was telling me it is “discouraging”. The bondage of debt is discouraging! And what do many young graduates do - load up more debt and buy a new automobile! This debt can be extremely onerous! Read more about auto

Becoming debt free should be a goal of each person. I have seen young college graduates who have finished school with well over $200,000 in student loans. As one client was telling me it is “discouraging”. The bondage of debt is discouraging! And what do many young graduates do - load up more debt and buy a new automobile! This debt can be extremely onerous! Read more about auto