September is National Life Insurance month - let me guess, you did not know that we had a national life insurance month, few people do. Now is the time to make the public more aware of life insurance and its uses and benefits. There are two main questions people ask when talking about life insurance: How much do I need? and What type of life insurance should I have?

While those two questions are important, they are often answered like this: buy approximately five to ten times your annual income, and buy the cheapest term insurance you can get. In reality there is much more to those questions than that! After all, life insurance is a major part of your personal financial foundation, it is there to protect your greatest asset: You, Your Life!

When building a financial strength, a solid foundation is needed, a person starts with risk management and estate planning. These two elements never go away. For as long as you live you will need to manage the risks you and your assets are exposed to and plan for the disposition of those assets upon your death - when ever that is.

Your assets consist of all the things you own: investments, bank accounts, home, vacation home, retirement accounts, automobiles, business assets, heirlooms, art, etc. The disposition of these assets becomes vitally important because if you don’t take the time to plan for their distribution, by law the state government, where ever you live, will tell your heirs how your assets will be divided.

Most people have all of their assets insured, certainly their home and its contents, bank accounts, and automobiles. Those are very important assets, and improper use of automobiles can cause serious injury to another person if an accident were to occur. So the amount of life insurance may fall into an easy answer of five to ten times your annual income, sometimes a proper needs analysis should be done to determine the right amount. So what about the type life insurance…

Many financial advisors and drive-by financial planners (the ones on the radio) often simply tell folks all they need is cheap term life insurance. They say never get whole life or any other type of cash value life insurance, because “its too expensive.” Or if you want to “invest” your money put it in the market. Another classic one is, the goal is to accumulate enough money so you can “self-insure your life” so you don’t need any life insurance.

Now don’t get me wrong I am a firm believer in term insurance and I think it is a tool to use in the right circumstances, in addition to their base or foundation policy, that being a solid cash value policy. Term insurance was never meant to be the bedrock foundation of a person’s financial structure. A foundation should last more than 10 or 20 years. How would that work if your contractor who built you a new house put in a term foundation, telling you the concrete in the foundation is only good for 20 years then it will expire and the house will fall down! Or in order to keep the house standing you will need to replace the foundation in 20 years.

That would be an expensive foundation. Replacing and/or buying a new foundation for a 20 year old house would be really expensive! A term policy is more like the roof - you know that will wear out and need to be replaced at some point in time. Yes, it protects the house but it is not the foundation.

As a practicing professional, I have visited with many people over the years who had purchased a cheap term policy when they were younger believing that it would serve their needs. That was it - no other insurance. Fast forward to when the term policy is close to the end of its life and the person still needs insurance. For what ever reason they did not accumulate enough to, as the drive-by’s would say, “self-insure”. Only now to get the same amount of term insurance is cost prohibitive, and they certainly cannot afford the same amount of coverage with whole life. So they look at a reduced amount of death benefit. But now at their advanced age even a reduced amount is expensive. So that brings me to a question, that can be asked at any age: What is too expensive?

Obviously expensive means different things to each person and in relation to life insurance that is all over the board. But what is “too expensive”? They say that term insurance is cheap - then what defines cheap? Maybe we should start with the purpose of life insurance. Life insurance first and foremost is for your family, to protect your loved ones or others from the economic hardship that will occur upon your death. It is not for the insured person, it is for the people they leave behind.

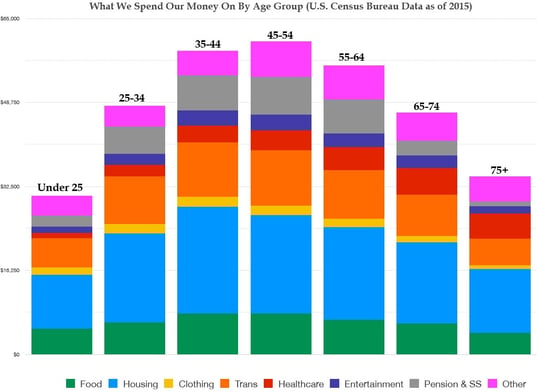

This means that a person has an economic value. Typically that economic value is determined by the income a person produces, the debts they carry, and their estimated final expenses. At a minimum a person should leave the world debt free. A question is then asked: Do people have an economic value clear into retirement and even into their 80’s or 90’s? Yes they do. Remember the economic value is not for the insured who may be 85 or 90 years old; it is to help the people that person may leave behind. And those values can change and the people left behind may change over time too. But value is still there. And because there is value, there is a need for life insurance.

Now about the type of coverage, obviously the only good policy is one that pays a death benefit when a person dies. All other policies are not relevant. The premium to buy the policy may not be relevant. Only if the policy is in force and pays a death benefit is the policy of any value.

Understanding that key element, a term policy may or may not be in force when the insured dies. It all depends if the insured happened to die within the term period and if the premiums were paid. The saddest thing is when a person dies shortly after their term policy expired or lapsed, leaving nothing for their heirs. There is a reason term insurance is so “cheap”, most policies never pay a death benefit. If more term insurance paid a death benefit, the premiums would be more expensive.

In reality the most expensive policy is one in which a person paid on for years and years and then lapses before death and heirs never received a penny. Even the policies that cost only $50 per month, over a year that is $600 and over 20 years that is $12,000!

What about a whole life policy, it is more expensive? For the same policy that may cost someone $50 per month may cost $250 per month or $3000 per year. Yes that is true, however this policy will likely still be in force when the person dies and will actually pay the death benefit. Giving the heirs much needed thousands of dollars. Yes initially it costs more $50 vs. $250 but if the policy actually pays a death benefit and the other does not, which one cost more?

The amount of insurance you carry and the type of insurance you have are important particularly when you look out twenty, thirty, or even 50 years from now. I still have my first whole life policy I bought when I was 18 years old. It has served me very well and I have used it (the cash value) on several occasions, such as to purchase an automobile. It has been a solid part of my financial foundation and protected my family well. I bought that policy long before I ever knew that I would spend most of my professional life serving people in the financial sector and I am so grateful I did!

REMEMBER:

"The only good life insurance policy is one that pays on death." Wendell Brock

tify our wants into needs - its a matter of developing the strongest argument as to why this or that is a need not a want, thus eating up our entire pay check on the mixture of real needs and perceived needs (real wants).

tify our wants into needs - its a matter of developing the strongest argument as to why this or that is a need not a want, thus eating up our entire pay check on the mixture of real needs and perceived needs (real wants).

retirement will still have these expenses.

retirement will still have these expenses.