During the final days of 2014, the government issued a report stating that the GDP had grown by 5% in the third quarter of the year. Many are cheering the news, but there are also many who are calling slight of hand! I have three articles that I will reference to dissect this report, one supports the government's claim, and two oppose.

The first article is called “Why Aren't We Thanking 'Gridlock' For Saving The Economy?” written by David Harsanyi. His reasoning for the 5% jump is that for the first time in the Obama administration, no one was 'tinkering' with the economy. To be fair, he doesn't give credit to Obama for turning it around, nor does he give congress the credit. Rather he says that because of gridlock in D.C., no one was able to accomplish anything, and just the mere fact of letting the economy maneuver for itself, allowed it to begin to pull out of this long recession.

The first article is called “Why Aren't We Thanking 'Gridlock' For Saving The Economy?” written by David Harsanyi. His reasoning for the 5% jump is that for the first time in the Obama administration, no one was 'tinkering' with the economy. To be fair, he doesn't give credit to Obama for turning it around, nor does he give congress the credit. Rather he says that because of gridlock in D.C., no one was able to accomplish anything, and just the mere fact of letting the economy maneuver for itself, allowed it to begin to pull out of this long recession.

By John Hendrix

From Harsyani, ““People often don’t realize that a political system is sometimes effective when it does not do certain things.” Pietro Nivola, a senior fellow in governance studies at the Brookings Institution, argued in 2013. “You can’t just measure the things it does, the actions it takes; you also have to measure the actions it does not take.” Nivola’s study was impressed by how gridlock has the ability to stop the Republican House from cutting spending too abruptly for the economy.

“And perhaps he’s right. Gridlock has caused an odd, but pervasive, stability in Washington. Spending has been static. No jarring reforms have passed — no cap-and-trade, which would have artificially spiked energy prices and undercut the growth we’re now experiencing. The inadvertent, but reigning, policy over the past four years has been, do no harm.”

I have always thought that if congress could only pass one new tax law, (one that raised revenue to the Federal Government in any way), every seven years, the economy would be much better off. This would give the public time to absorb the law before a whole new set of rules and regulations come out to hit us again.

Harsanyi also mentions that the congress has issued fewer laws during the last few years. While there may have been fewer laws passed, he overlooks the fact that the ones that have passed have been so large that the congressmen don't have time to read them before they come up for a vote. To quote Senetor Pelosi, “We won't know what is in the law until after it has passed.” A foolish way to govern and far from the do no harm policy Harsanyi claims.

Further, while the number of laws issued may be less than in other years, the amount of regulations pouring out of D.C. have been more than most people can keep track of. There were over 3,000 that were ready for take-off the week of Thanksgiving alone! There were just as many issued back in the spring. While congress can't take credit or blame for these, they certainly do impact the economy in big ways.

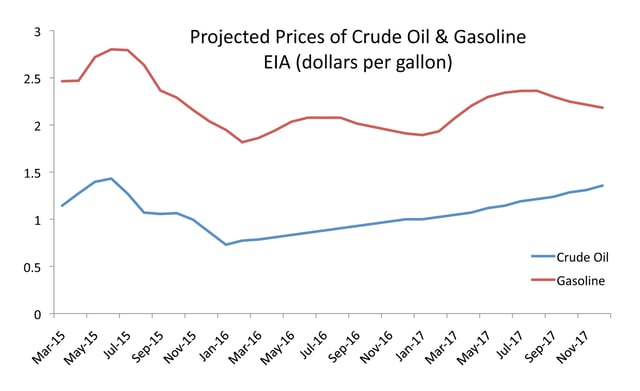

For example, the energy sector is being regulated out of their current system into a coal-free one. We can debate all day what is the most earth-friendly method of creating a stable energy network that will serve our population needs in the most cost effective and efficient manner. However, in the past, the free-market and innovation led us to new advances, not regulations and red tape.

As a matter of course, it used to be that laws were presented by congress, to be enforced by the executive branch and appealed to through the judicial branch. Regulations by-pass our entire system of checks and balances, leaving us with a penal system that is deaf to any appeals. I submit that regulations are more damaging to a free economy than a president's policies or legally enacted law.

The next article, “Q3 GDP Jumps 5%; Ha! The Crap Behind the Numbers” written by Tony Sagami of Mauldin Economics. In this article he doesn't necessarily cry foul, but he raises some doubts about the integrity of the 5% claim because of other numbers in the economy that don't add up to a jump. He outlines four points:

“Fun with Numbers #1: The biggest improvement was in the Net Exports category, which increased by 112 basis points. How did they manage that? There was a downturn in Imports.

“Fun with Numbers #2: Of the 5% GDP growth, 0.80% was from government spending, most of which was on national defense. I’m a big believer in a strong national defense, but building bombs, tanks, and jet fighters is not as productive to our economy as bridges, roads, and schools.

“Fun with Numbers #3: Almost half of the gain came from Personal Consumption Expenditures (PCE) and deserves extra scrutiny. Of that 221 bps of PCE spending:

Services spending accounts for 115 bps. Of that 115, 15 bps was from nonprofits such as religious groups and charities. The other 100 bps was for household spending on “services.”

Of that 100 bps, the two largest categories were Healthcare spending (52 bps) and Financial Services/Insurance (35 bps).

“The end result is that 85% of the contribution to GDP from Household Spending on Services came from healthcare and insurance! In short… those are code words for Obamacare!

“While the experts on Pennsylvania Avenue and Wall Street were overjoyed, I see just another pile of white-collar manure and nothing to shout about.

“Fun with Numbers #4: Lastly, the spending on Goods—the backbone of a health, growing economy—declined by 27 bps.”

With this in mind, let's move on to the third article posted on December 26, 2014 by John Hinderaker in Economy, Obamacare, & PowerLine called, “About that 5% GDP Growth Rate…”. Citing another economist, Tyler Durden at Zero Hedge, Hinderaker helps uncover the sleight of hand being played out and points the finger assuredly on Obamacare spending as the main reason for the jump in the economy.

“Back in June, when we were looking at the final Q1 GDP print, we discovered something very surprising: after the BEA had first reported that absent for Obamacare, Q1 GDP would have been negative in its first Q1 GDP report, subsequent GDP prints imploded as a result of what is now believed to be the polar vortex. But the real surprise was that the Obamacare boost was, in the final print, revised massively lower to actually reduce GDP!

Of course, even back then we knew what this means: payback is coming, and all the BEA is looking for is the right quarter in which to insert the “GDP boost”.

Don’t worry though: this is actually great news! Because the brilliant propaganda minds at the Department of Commerce figured out something banks also realized with the sub “kitchen sink” quarter in November 2008. Namely, since Q1 is a total loss in GDP terms, let’s just remove Obamacare spending as a contributor to Q1 GDP and just shove it in Q2.

Stated otherwise, some $40 billion in PCE that was supposed to boost Q1 GDP will now be added to Q2-Q4.

And now, we all await as the US department of truth says, with a straight face, that in Q2 the US GDP “grew” by over 5% (no really: you’ll see).”

While the exact quarter predicted was incorrect, the overall scheme was called out back in June with 'Obamacare' spending accounting for two-thirds of consumer spending. We can only hope that increasing Obamacare costs don’t drive “personal consumption” any higher in future quarters, and also that integrity can somehow return to our public servants.

So we come to the final question: what really happened to the numbers? Anyone want to guess – let me know what you think?

California’s current statewide minimum wage of $10 per hour is already among the highest in the country. The state of New York is also considering raising its minimum wage to $15 per hour, where fast food restaurants are already subject to a $15 per hour minimum.

California’s current statewide minimum wage of $10 per hour is already among the highest in the country. The state of New York is also considering raising its minimum wage to $15 per hour, where fast food restaurants are already subject to a $15 per hour minimum.

The first article is called “Why Aren't We Thanking 'Gridlock' For Saving The Economy?” written by David Harsanyi. His reasoning for the 5% jump is that for the first time in the Obama administration, no one was 'tinkering' with the economy. To be fair, he doesn't give credit to Obama for turning it around, nor does he give congress the credit. Rather he says that because of gridlock in D.C., no one was able to accomplish anything, and just the mere fact of letting the economy maneuver for itself, allowed it to begin to pull out of this long recession.

The first article is called “Why Aren't We Thanking 'Gridlock' For Saving The Economy?” written by David Harsanyi. His reasoning for the 5% jump is that for the first time in the Obama administration, no one was 'tinkering' with the economy. To be fair, he doesn't give credit to Obama for turning it around, nor does he give congress the credit. Rather he says that because of gridlock in D.C., no one was able to accomplish anything, and just the mere fact of letting the economy maneuver for itself, allowed it to begin to pull out of this long recession.