Long-term care (LTC) insurance allows people to pay a known premium to help protect against the risk of much larger out-of-pocket expenses down the road. This article will help you understand some of the things to consider when purchasing an LTC polciy.

Taxation

When considering policy taxation, there are two general types of long term care policies, they are:

- Tax qualified (TQ) policies which are the most common policies offered. As per HIPPA, a TQ policy requires that a person 1) be expected to require care for at least 90 days, and be unable to perform 2 or more activities of daily living (eating, dressing, bathing, transferring, toileting, maintaining continence) without substantial assistance (hands on or standby); or 2) for at least 90 days, need substantial assistance due to a severe cognitive impairment. In either case a doctor must provide a plan of care. Benefits from a TQ policy are non-taxable.

- Non-tax qualified (NTQ) which was formerly called traditional long term care insurance. It often includes a "trigger" called a "medical necessity" trigger. This means that the patient's own doctor, or that doctor in conjunction with someone from the insurance company, can state that the patient needs care for any medical reason and the policy will pay. NTQ policies may include walking as an activity of daily living and usually only require the inability to perform 1 or more activity of daily living. The Treasury Department has not clarified the status of benefits received under a non-qualified long-term care insurance plan. Therefore, the taxation of these benefits is open to further interpretation. This means that it is possible that individuals who receive benefits under a non-qualified long-term care insurance policy may risk facing a large tax bill for these benefits.

Fewer non-tax qualified policies are available for sale. One reason is that consumers want to be eligible for the tax deductions available when buying a tax-qualified policy. The tax issues can be more complex than the issue of deductions alone, and it is advisable to seek good counsel on all the pros and cons of a tax-qualified policy versus a non-tax-qualified policy, since the benefit triggers on a good non-tax-qualified policy are better.

Most benefits are paid on a reimbursement basis and a few companies offer per-diem benefits at a higher rate. Most policies cover care only in the continental United States. Policies that cover care in select foreign countries usually only cover nursing care and do so at a rated benefit.

Partnership Plans and Medicaid

The Deficit Reduction Act of 2005 makes Partnership plans available to all states, although not all states participate in this program. Partnership plans provide “lifetime asset protection" from the Medicaid spend-down requirement.

In return for purchasing partnership policies, a portion of a policyholders’ assets will be disregarded when determining their eligibility for Medicaid long-term care services, if and when they apply for such services. Traditionally, to be eligible for Medicaid, applicants’ assets cannot exceed certain financial eligibility thresholds.

When applying for Medicaid long-term care benefits, the Partnership program allows individuals who purchase qualifying insurance policies to retain one dollar in assets for each dollar of long-term care insurance benefits paid by the policy. For example, the typical asset limit for an individual applying for Medicaid nursing home services is $2,000. If an applicant received $100,000 in benefits through a partnership program insurance policy, they may retain up to $102,000 in assets.

Deductibles

Most policies have an elimination period or waiting period similar to a deductible. This is the period of time that you pay for care before your benefits are paid. Elimination days may be from 20 to 120 days. The longer the elimination period the lower the premium. Some policies require that the policy for long-term care be paid up to one year before becoming eligible to collect benefits.

What About Inflation

Because the daily or monthly benefit amount you buy today may not be enough to cover higher costs years from now, most policies give you the option of adding an inflation protection feature, for an additional premium cost. With automatic inflation protection, the initial benefit amount increases automatically each year at a specified rate, such as 3%.

Another form of inflation protection is the guaranteed purchase option. This gives you the option of increasing your benefit amount and your premium every few years. Policies without inflation protection cost less, but their benefit amounts do not increase and may be inadequate if you need long-term care many years from now.

Nonforfeiture Option

Some people feel that if they pay premiums on an insurance policy for years but later drop the policy, they should receive some payment. A policy with nonforfeiture provision does this. Most companies offer nonforfeiture options on long-term care policies. However, that can add from 20% - 100% to the cost of the premium.

Asset Based Policies

Other LTC policies are “asset based” meaning that they are based on an annuity, or a cash value life insurance policy. The benefit of these types of policies are the favorable underwriting, which is a blend of LTC and life insurance underwriting, giving people who may not qualify for one specific type of policy, be able to get a policy this way. Or LTC and annuity underwriting again may provide a benefit to the insured.

An example is a person who for one health reason, like diabetes who was turned down for regular LTC insurance, may be able to obtain a policy via an asset based policy.

This can also provide additional stability for other investments. A fixed annuity provides a solid fixed rate of return, even at three percent, it is much higher than zero! Also with the right annuity you may be able to withdraw money income tax free when those funds are used for qualified long-term care expenses.

A problem with long-term care insurance is that statistically 30 percent of people don’t end up using it and they feel like they have wasted all those expensive premiums. So the asset based policy solves this problem, it is not a “use it or lose it” policy. If you use it for long-term care great, if not then it is left to your heirs as part of your estate plan, either way the policy is preserving your estate. If the policy holder decides to cash it in then they can do that also, in some cases getting more than what they put in the policy.

Because long-term care policies are purchased by more people at or near retirement in preparation for what may happen in near the end of life. The question is this; is your retirement plan complete without some sort of long-term care plan in place? For most Americans, 93% of them, older than 60 years old, the answer is NO. And then for those who are younger than 60 what about your parents? What do they have in place? If they have nothing, will they be moving in with you? If you have questions about who needs long-term care insurance read Who Needs Long-Term Care Insurance.

Remember:

It's been said, "It isn't happy people who are grateful, it is grateful people who are happy!"

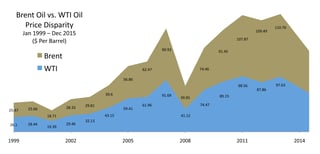

Realization of an oversupply issue put pressure on oil prices throughout 2014 & 2015. Crude oil production in the U.S. has surged because of the technology behind horizontal drilling and hydraulic fracturing, primarily in the states of North Dakota and Texas. Fracking makes it possible to extract oil and natural gas in places where conventional technologies are not effective. Fracking involves the use of high water pressure combined with sand and chemicals to create cracks in rock that allow the oil and natural gas it contains to escape and flow out of a well.

Realization of an oversupply issue put pressure on oil prices throughout 2014 & 2015. Crude oil production in the U.S. has surged because of the technology behind horizontal drilling and hydraulic fracturing, primarily in the states of North Dakota and Texas. Fracking makes it possible to extract oil and natural gas in places where conventional technologies are not effective. Fracking involves the use of high water pressure combined with sand and chemicals to create cracks in rock that allow the oil and natural gas it contains to escape and flow out of a well.

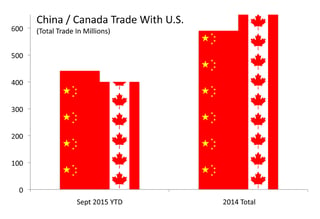

Commerce. Through September 2015, China had more import and export activity with the United States than Canada, the first time to ever occur. Total trade in 2014 with China and Canada was close, but now China has clearly eclipsed Canada as the primary trade partner with the U.S.

Commerce. Through September 2015, China had more import and export activity with the United States than Canada, the first time to ever occur. Total trade in 2014 with China and Canada was close, but now China has clearly eclipsed Canada as the primary trade partner with the U.S.